Payroll

$50.00

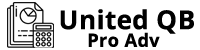

Payroll services that go beyond a paycheck.Pay your team and access HR and benefits with the #1 payroll service provider.

Features

- Automated Payroll: QuickBooks Payroll automates your payroll process, including calculating paychecks, taxes, and deductions. This helps you save time and reduce errors.

- Direct Deposit: The software offers direct deposit for your employees, which saves time and eliminates the need for paper checks.

- Tax Compliance: QuickBooks Payroll helps you stay compliant with federal and state tax regulations. The software calculates and pays your payroll taxes, and also generates year-end tax forms such as W-2s and 1099s.

- Employee Portal: The software includes an employee portal where your team members can access their pay stubs, W-2s, and other important documents.

- Mobile App: QuickBooks Payroll offers a mobile app that allows you to manage your payroll on-the-go. You can approve payroll, view employee information, and run reports from your phone or tablet.

- Integration with QuickBooks: The software integrates seamlessly with QuickBooks Online, allowing you to manage your payroll and accounting in one place.

Reviews

There are no reviews yet.